In addition to making partial withdrawals a key feature of our CD offerings, our bank has taken the punishment out of early withdrawal penalties. With our CDtwo® withdrawals only carry penalties if they damage the bank. The penalty is not based on some worst-case scenarios like other banks use, but is based on what it would cost us to replace the funding. In fact, if the withdrawal is beneficial to the bank because we could replace the deposit with less expensive funds, we pass the benefit to the depositor for early withdrawal. Bank clients could get all of their principal and interest plus extra interest for withdrawing early.

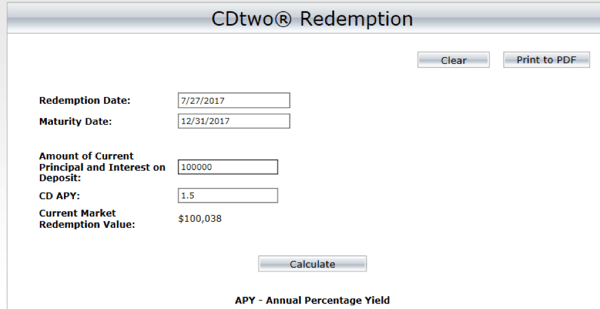

Does your bank offer partial withdrawals, customized maturity options and penalties that are based on the actual impact on the bank? Check out what your CD early withdrawal option would be today by using our online redemption calculator.

Here is an example on a $100,000 CD that matures on 12/31/2017.

Contact The Bank of TIoga to get a full demonstration and take advantage of this great opportunity!

*Regulations require a penalty of at least seven days of interest on CDs if withdrawn in the first seven days. CDtwo® is a trademark of Stanley Performance Strategies LLC. There is a penalty for early withdrawal only if interest rates rise. The penalty for the first seven days is seven days of interest. After the first seven days, the penalty/bonus is determined by the Replacement Fee. The Replacement Fee is an estimate of the interest cost to us if we were to replace a CD that is withdrawn early with another deposit having a term that is comparable to the remaining term of the original CD. Five through 60-month terms available. If interest rates have risen, then the cost of the new deposit will be higher. If interest rates have fallen, then the cost of the new deposit will be lower. The Bank of Tioga reserves the right to limit deposits to this account.